How Best To |

In working with clients, I am often asked what is the best way to fund a college education. Is the 529 plan the best way? A Typical Client Is A Grandfather In His 70's who would like to deposit about $60k into a fund for an infant grandchild to grow safely for his college education or parents who want to save for their child’s education. A 529 plan is not tax deductible but will grow tax-free to pay for education-associated costs. Mutual funds, stock portfolios and bank accounts are typical funding vehicles for this plan, but the first two are two volatile and uncertain, the bank’s returns are unacceptable and annuity carriers do not allow their products to be used in a 529 plan. What to do? For the rest of the discussion, we are assuming that we have 18 years to accumulate the money (at which time Grandpa will be in his 90s or has died), we suggested he look seriously at life insurance as a funding vehicle. By depositing $60,000 in an Index Universal Life policy with a minimum death benefit, he could take advantage of the cash value crediting rates equal to the S&P gain (currently up to 14%) with no downside risk in losing years. The cost of insurance would reduce the annual increase by about 1% and all of the gains are tax deferred, just like the 529 plan. If Grandpa passes away before Junior gets to college, he leaves a significant tax-free death benefit to help pay for Junior's education...or anything else for that matter. If he is still alive, he will have many options: |

Since there is no way to know what the tax laws will look like in the future, Grandpa should just focus on accumulating the most money safely and tax deferred. When the money is needed, they can do tax planning utilizing the opportunities available at that time. The value of this approach is that we can count on getting the best tax-deferred growth on the money with safety, tax-free availability of money for college expenses, a possible tax-free distribution if not taken until after Grandpa's death and any number of options to take money otherwise. Indexed Universal Life Insurance (IUL) currently enjoys a 13%-14% Cap on S&P growth credited

|

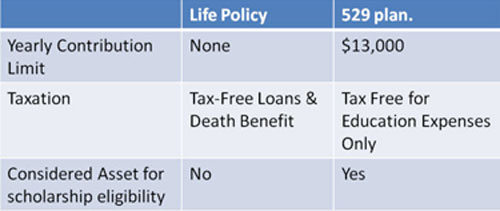

to the cash value without any risk of loss to the cash value due to market conditions. Once the interest is credited, it can never be taken away. This means that the policy will receive interest on the first 13% or 14% growth in the S&P 500 index each year not ever having to worry about losing it due to market performance. Grandpa will continue to control the money and even tap the death benefit himself if long-term care is needed*... something to consider before plunking down a lump sum into a mutual fund or other risky stock market investment under 529. performance, relative to the current 14% cap rate, tax free returns of approximately 7% tax can be achieved (Note: Past performance is not a guarantee of future results). The important thing is that the policy will be credited with the increase in the S&P (up to 14% per year, less the cost of the insurance) without the volatility or down side risk that you would have with risky market alternatives. Using Indexed Universal Life Insurance (IUL) is also A Great Way For Parents To Save For College For Their Children. It will perform even better than a policy purchased by grandparents because the cost of the life insurance itself is less expensive for the parents than the grandparents due to age and possible health issues. Regardless of who purchases the policy, the IUL is a great way to accumulate cash for college or other expenses. Contact Statewide Insurance Co. at (954) 781-2220 or swinspro@gmail.com to receive your complementary illustration customized to your situation. Obviously the cash value will vary depending on the results in the S&P. Based on historical experience if invested in a risky stock market related product. For those who want guarantees, there are options which will return a competitive guaranteed tax free return which is defined by the insurance company each year. You not only get the Death Benefit Family Protection and Living Benefits such as payment for Long-Term Care if needed, but also a tax-free accumulation of cash that can be used for college expenses or anything else that you want cash for. The following chart shows a comparison of the advantages and disadvantages of choosing Indexed Universal Life vs a 529 plan to fund college expenses.

Sample Case 1. Zero Cost Loans are loans charged and credited at the same percentage for a net zero cost. The policy year and amount available vary by product. Ask us about our GUARANTEED COLLEGE SCHOLARSHIPS available at 300 colleges located all over the US, including Florida. No purchase or investment is needed. Call us at (954) 781-2220. Cli’ck Here to request your $500 “starter” scholarship coupon.

Scholarships up to 25% of the child’s tuition. Call us today at 1-954-781-2220 or fill out this short survey so that you can set up an appointment with one of our top licensed agents.

|

|

** New ** 8 hour Workshop: Conservative Investing Techniques In Our Current Environment. Cl'ck here for details. Cli'ck Here to Get Your FREE gift that will help you plan for long-term care expenses. and your income for life illustration. Go To SMARTMONEY Newsletter Archives Website: www.StatewideRetirementPlanning.com

Review our Highly Acclaimed Videos: Review our 10-minute video “Paycheck For Life” Statewide Retirement Planning Co. |

|